Propping Up Tax Havens

Propping Up Tax Havens

Last week, finance Minister Bill Moreau was cleared by the Federal Ethics Commissioner of any wrongdoing related to his sale of shares “Morneau-Shepell” a company he owned prior to becoming Minister.

It was the end to a saga that exploded in the media spotlight back in November with the opposition hammering the Minister relentlessly for his alleged - now disproven - insider trading.

But something else happened in November that neither the opposition, the Ethics commissioner not the Conservative opposition seemed to have taken any serious interest in: allegations around the Liberals and tax havens.

In November, Stephen Bronfman, a member of the billionaire Bronfman family (best known for Seagrams’s Whiskey), was implicated in the Paradise papers. Bronfman is not only considered to be a member of Trudeau’s inner circle, but is also the chief revenue officer for the federal Liberal Party.

The documents laid out how Bronfman was making million dollar loans to an offshore trust, which his investment company and the Bronfman family advised and did business with.

The Conservatives did talk about the issue for at least a day, but since then, not a peep.

In the meantime, Pierre Poilievre, the Conservative finance critic (and the NDP’s Nathan Cullen) asked the ethics commissioner to investigate Morneau’s shares while the Conservatives are currently trying to force the prime minister to answer questions from the government's ethics committee about his ethics-code breaking vacation on the Aga Khan's island.

So why the silence on Bronfman and tax havens, a target that’s bigger, cuts closer to the Liberals and also one of their biggest money men?

'Most Powerful Lobby'

“The offshore and taxation lobby is the most powerful in this country,” said Diane Francis of the Financial Post, when asked by the National Observer why Canada doesn’t have the political will to put an end to the abuse of offshore tax havens.

Few better examples exist than tax havens as to who is actually running the country… and it’s not the general public. While polls continue to show 90% support for ending the use of tax havens in Canada, almost all of the country’s political leadership is implicated in their use and support.

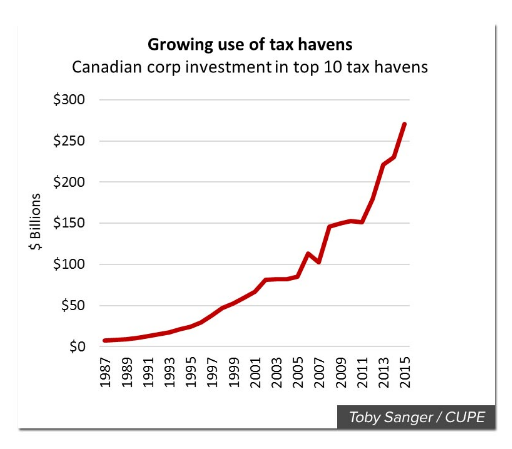

The Conservatives under Stephen Harper oversaw an explosion in the use of tax havens and Canada became a global leader in their use. Money flowing into tax havens shot up to $270 Billion a year in 2015, up $40 Billion from the year before.

A year later, Harper went onto to work for Dentons, a Canadian law firm that provided advice to KPMG clients about using tax schemes to hide assets. The relevation caused a major scandal for KPMG. Other former Conservative MP’s currently work for Denton’s while other Conservative MP’s and leadership candidates have links to offshore tax evasion.

The last big push to regulate tax havens was done by the EU in 2013. But the attempt by some European nations (which may or not have been earnest) to go after tax cheats at the G8 was scuttled by Canada. According to the Financial Times:

"Stephen Harper, Canada’s prime minister, is resisting – partly on the grounds of tax confidentiality – plans to crack down on aggressive tax avoidance and evasion by requiring the disclosure of the ultimate owner of shell companies."

Recent revelations in the Paradise Papers have exposed exactly where Harper got his ideas in 2013 and how the tax haven lobby was able to get their way.

IFC Forum

The International Financial Centre (IFC) Forum is a tax-haven lobby group funded by 11 of the world’s biggest offshore law firms. The Forum was heavily profiled in a joint CBC - Toronto Star investigation into the Paradise Papers. When the push against tax havens was on, IFC Forum went on the attack, meeting with government officials from a half-dozen countries and pitching stories to prominent publications around the world.

Richard Hay, a Canadian, Osgoode Hall-trained, lawyer licensed to practice law in Ontario, runs Canadian law firm Stikeman-Elliott. Hay, also an IFC Forum representative, worked his magic in the Economist on June 15, 2013:

“They [campaigners pushing for tax haven transparency] have been “dictating the script lately”, complains Richard Hay, counsel to the IFC Forum, a lobby group for offshore lawyers: “Cameron has been reading from it.”

Sometime in June, prior to the summit on June 16 - 17, he was also meeting with Canada’s G20 (emissary) and Deputy Minister of International Trade, Simon Kennedy, in London.

According to IFC Forum minutes, Hay had some success, reporting on a July 23, 2013 conference call that “Canada, Germany and Russia were reluctant to endorse the U.K. G8 agenda. The Canadians are reluctant to participate in the U.K. transparency agenda but given the outcome of G8 feel under pressure to consider,” (quotes from Toronto Star).

Kennedy denied the IFC’s account of what was said, but met Hay again in January 2014.

According to the CBC - Toronto Star expose on the issue:

“There is no official trace of the meeting. Kennedy said he did not have any paperwork and Global Affairs Canada found no records of it in response to eight separate access-to-information requests.

“The meeting was not reported to the lobbying commissioner, even though Hay, as a paid lobbyist for the IFC Forum, is required to register and report his meetings with senior government officials.”

Lobbying without registering “is a serious breach” of the Lobbying Act, said Ian Greene, professor emeritus of public policy and administration at York University and author of Honest Politics: Seeking Integrity in Canadian Political Life."

While the Ethics commissioner has openly discussed it’s investigation, and outcomes, around Morneau, according to the Star “three federal commissioners — the lobbying commissioner, the integrity commissioner and the conflict of interest commissioner — declined interviews and would not comment about this case.”

The Forum in the UK

While the Star and CBC both reported widely on IFC Forum’s handiwork in Canada, no one bothered to point out that the exact same thing was happening in the UK at the same time.

According to the Guardian:

“The International Financial Centres Forum worked frantically behind the scenes to thwart a regulatory overhaul that would have introduced new obligations for Britain’s overseas territories and crown dependencies.

”The group “spoke of having “superb penetration” at the highest levels of the British government before the G8 summit in question."

Reports by the Guardian note that on 9 June, a week before the 2013 G8, IFC "secured an 80-minute meeting with Dominic Martin, a senior official in the Cabinet Office who was then director of the UK’s G8 presidency unit."

In the weeks leading up, IFC was also able to "secure meetings with David Gauke, then the exchequer secretary to the Treasury, senior officials at HMRC (the UK version of the CRA), the permanent secretary at the Department for Business, Innovation and Skills, and two Tory peers, Lord Blencathra and Lord Flight."

“Two days before the summit, the IFC said, it secured another “crucial meeting” with the senior Treasury official Shona Riach.”

Clean As Snow In The Great White North

While the ICF Forum and Hay secured victory, revelations around the use of tax havens in Canada continue to filter out.

All but 4 of the largest publicly-traded companies in Canada (the tsx/s&p 60) collectively have more than 1,000 subsidiaries in tax havens. According to a report from Canadians for Tax Fairness this is costing Canada between $10 billion to $15 billion annually in lost tax revenue.

While the CRA could be using the Paradise Papers leak to go after corporations and individuals, it doesn't look like they are doing so with the 2016 leak of the Panama Papers, something they were accused of doing under the Harper Conservatives with two other big data leaks in 2007 and 2009.

Several other governments say they've recovered around $500 million in unpaid taxes (total) thanks to the Panama Papers leak. The CRA says that it will be years before they get to recovering money.

The timeline fits. TSX/SP 60 company Loblaws is currently in battle with the CRA over use of accounts in Barbados and an evasion scheme from 2001 - 2010. The government claims the grocery group set up a fake bank to "avoid tax on hundreds of millions of dollars in investment income, that could see them pay $404 million in tax, including interest, penalties and provincial income tax.”

Loblaws was also revealed in the Paradise papers as having used offshore holding companies in Barbados and Bermuda to shield profits from tax and was also found to be engaging in an illegal 15 year price-fixing cartel.

Meanwhile, Canada has been revealed to be basin of tax evasion as well. The CBC-Toronto Star investigation into the Paradise papers found that “a legion of tax advisers have been using Canada to help hide assets.” The story became known as the “Canadian ‘Snow Washing’ ” scandal.